3. The design of the tax and benefit system in Lithuania | OECD Tax Policy Reviews: Lithuania 2022 | OECD iLibrary

Chapter 4. Economic and Political Determinants of Tax Policies in OECD Countries in: Fiscal Politics

Personal Income Tax Rate Ppt Powerpoint Presentation Icon Themes Cpb | Presentation Graphics | Presentation PowerPoint Example | Slide Templates

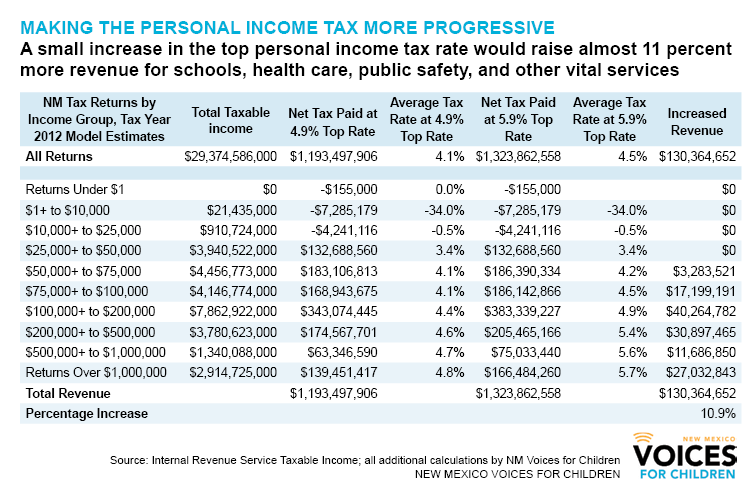

Why the poor pay the highest tax rate in New Mexico—and one step toward a fix – New Mexico Voices for Children

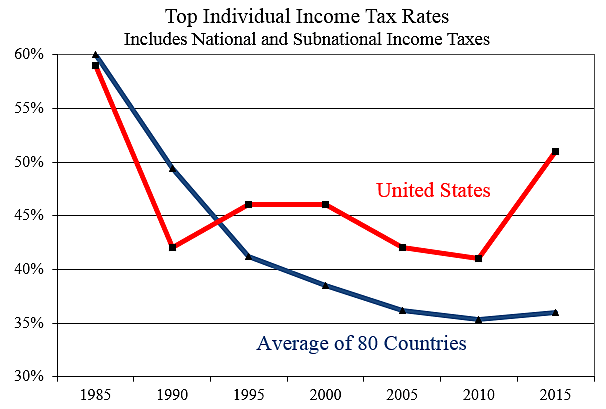

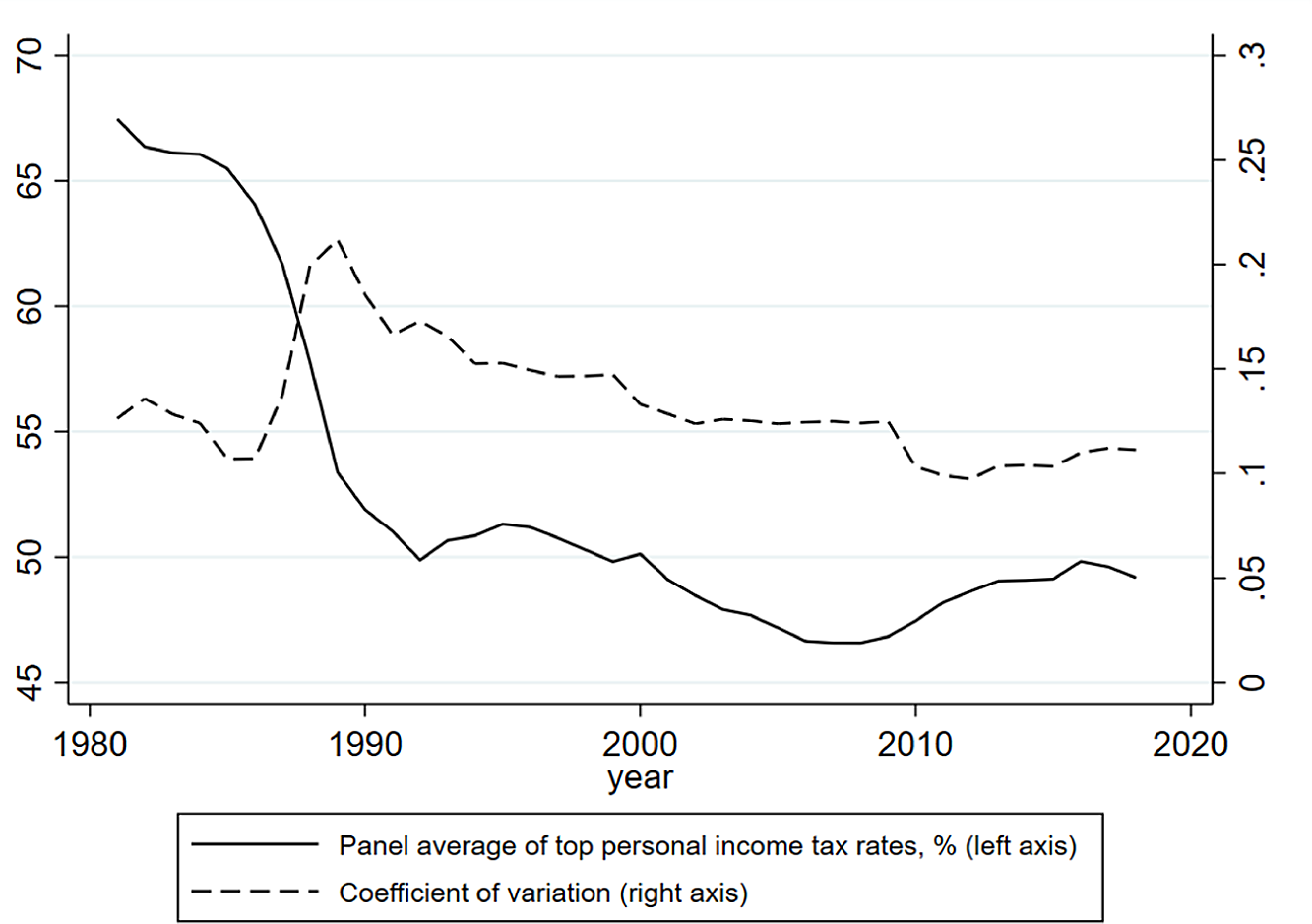

Determinants of top personal income tax rates in 19 OECD countries, 1981–2018 | Journal of Public Policy | Cambridge Core